We’re living in a fast-paced world with piles of opportunity, but a little less time. That said, it’s difficult to manage things that require time.

So when you’ve multiple bank accounts to be managed, it won’t be easy to track them all. To solve such a problem, personal finance apps come into play, allowing you to monitor your balance linked to multiple accounts, all in one dashboard.

Whether you’ve a checking account for daily expenses, a savings account for that summer holiday, or a joint account with your wife, and the credit card you use to splurge cash online.

It will be easier for you to manage all your banking sources without losing your mind and a beat.

That’s where budgeting apps come in, acting like a financial GPS to guide you through the chaos.

These apps are more secure and jammed with features to help you stay in control.

Why You Need an App to Track All Bank Accounts?

Let’s be real: logging into five different bank apps or squinting at spreadsheets is a recipe for frustration.

Maybe you’ve got accounts at Chase, a savings stash at Ally, and a credit card with Capital One.

Checking each one separately eats up time, and it’s easy to miss a low balance or an unexpected fee.

A good app pulls all your accounts into one place, giving you a clear snapshot of your money.

No more mental math to figure out if you can afford that new gadget or if you’re overspending on takeout.

These apps do more than just show balances. They categorize your spending, flag sneaky subscriptions, and even nudge you toward savings goals.

What’s more? With 256-bit encryption and biometric logins, your data stays safe.

Whether you want to connect your banks in one finance app or scour a budgeting app, the right app can save you time, stress, and maybe even a few bucks.

So, which ones are worth downloading? We’ve tested features and checked security to bring you the best of the bunch.

Best Apps to Track Multiple Bank Accounts – Top Picks

Here’s our handpicked list of the best apps to manage your accounts, each with unique strengths to suit different needs. We’ve included costs, standout features, and who they’re best for, so you can find your perfect match.

Quicken Simplifi: The All-in-One Powerhouse

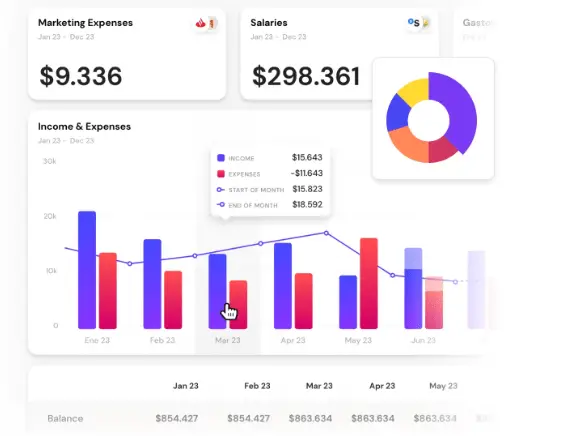

Quicken Simplifi is like the Swiss Army knife of budgeting apps. It syncs with over 14,000 financial institutions, pulling in your bank accounts, credit cards, loans, and investments for a complete financial picture.

Its sleek dashboard shows your spending, savings, credit score, and net worth in real time, with customizable reports to dig into details, like how much you’re really spending on coffee.

- Cost: $3.99/mo (40% off promotional rate as of 2026).

- Key Features:

- Syncs bank, credit card, investment, and loan accounts.

- Personalized spending plans that adjust as you spend.

- Goal tracking for savings or debt payoff.

- Educational resources like blogs and financial calculators.

- Who It’s For: Planners who want detailed insights and real-time adjustments. If you love diving into charts and tweaking budgets, this is your jam.

- Why We Love It: Simplifi’s user-friendly interface and robust syncing make it a breeze to track multiple accounts. It’s like having a financial advisor in your pocket, minus the hefty fees.

YNAB (You Need A Budget): The Proactive Budgeter’s Dream

YNAB is all about giving every dollar a job. Its zero-based budgeting approach forces you to assign every cent to expenses, savings, or debt before you spend.

It syncs with banks and credit cards, automatically importing transactions to keep your budget up to date. YNAB’s educational resources, like workshops and videos, are a bonus for anyone looking to level up their money game.

- Cost: $14.99/month or $109 annually (34-day free trial; free for college students with proof of enrollment).

- Standout Features:

- Syncs with bank and credit card accounts.

- Goal-setting for savings and debt repayment.

- Detailed reports to track spending trends.

- Extensive tutorials and live workshops.

- Who It’s For: Determined budgeters who want hands-on control. If you’re ready to rethink your spending habits, YNAB’s your coach.

- Why We Love It: YNAB’s proactive approach helps you plan ahead, not just track what’s already spent. Users report saving $600 in the first two months on average.

Banktrack: The Bank Aggregator Star

Banktrack stands out for its ability to sync with over 120 banks, including traditional giants and trendy neobanks.

Its bank aggregator feature pulls all your accounts into one intuitive dashboard, making it easy to see balances, transactions, and trends. It’s designed for folks who want a no-fuss way to monitor multiple accounts without drowning in features.

- Cost: “Business Starter”, €39/mo, allows up to 5 bank accounts, or Companies Advanced, €99/mo, allows up to 10 bank accounts. (Offers 7 days trial).

- Standout Features:

- Syncs with 120+ banks for a unified view.

- Real-time transaction updates.

- Bank-level encryption and biometric security.

- Supports Multi-users.

- Simple interface for quick checks.

- Who It’s For: Busy folks who need a straightforward app to monitor accounts without extra bells and whistles.

- Why We Love It: Banktrack’s focus on syncing tons of banks makes it ideal if you’ve got accounts scattered across multiple institutions.

Quick Note: If you need advanced budgeting tools, pair Banktrack with another app like YNAB for deeper analysis.

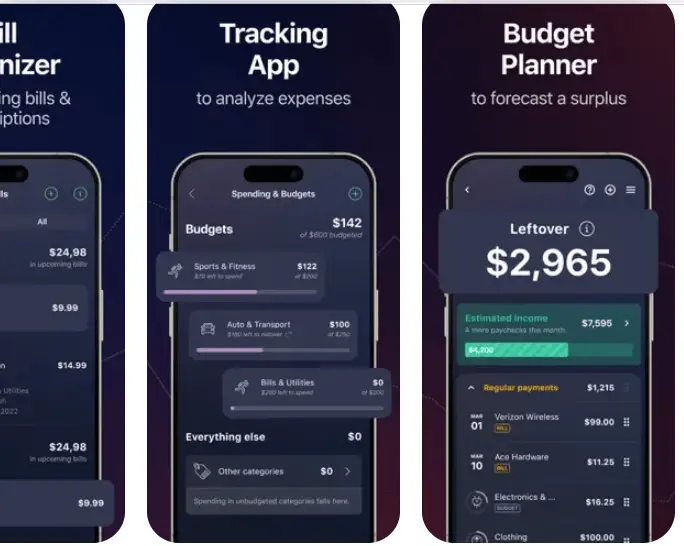

PocketGuard: The Overspending Guardrail

PocketGuard is your financial bodyguard, helping you avoid overspending. It syncs with bank accounts, credit cards, and investments, then calculates your “safe to spend” amount after accounting for bills and savings goals.

Its “In My Pocket” feature is a quick way to see what’s left for discretionary spending.

- Cost: Free basic version; PocketGuard Plus is $12.99/month or $74.99/year. (Also, 7-day free trial).

- Key Features:

- Syncs bank, credit card, and investment accounts.

- Automatic categorization of expenses.

- Debt payoff plans are in the Plus version.

- Alerts for overspending or bill increases.

- Who It’s For: Anyone who needs accountability to stick to a budget. Perfect for impulse shoppers or those paying off debt.

- Why We Love It: PocketGuard has a straightforward user interface, with no frills.

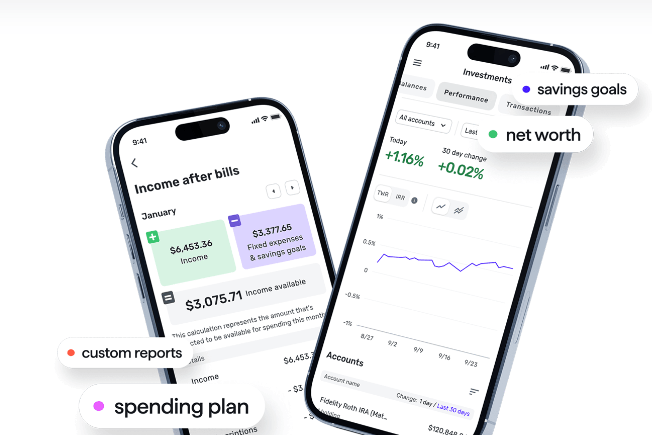

Monarch: The Goal-Setter’s Choice

Monarch Money is a newer player for tracking, planning, and budgeting your finances.

It lets you connect all your bank accounts and see a clear picture of your Cash flow, spending, and income, allowing you to plan your budget and set a financial goal.

Best of all, you can create as many savings goals as you want, and link them all for laser-focused saving.

- Cost: $14.99/month or $99.99/year (7-day free trial).

- Key Features:

- Unlimited customizable savings goals.

- Net worth and cash flow tracking.

- Zero-based budgeting option.

- Real-time syncing with financial accounts.

- Who It’s For: Ideal for goal-driven users who want a simple yet modern, all-in-one app for budgeting and tracking.

- Why We Love It: Its flexibility and sleek interface are easy on the eyes, especially if you’re handling multiple sections in your financial dashboard.

Honeydue: The Couple’s Financial Hub

There are so many budgeting apps for personal and business use, but Honeydue has a different approach. It’s built for couples who want to keep tabs on their finances all in one app.

To offload manual work, it connects multiple bank accounts, credit cards, loans, and investments, allowing couples to plan their financial goals.

You can even chat in-app about bills or transactions, keeping money talks organized.

- Cost: Free.

- Standout Features:

- Syncs joint and individual accounts.

- Customizable expense categories.

- In-app chat for financial discussions.

- Optional joint bank account (FDIC-insured).

- Who It’s For: Couples or roommates sharing finances. If you want transparency without merging everything, Honeydue’s your pick.

- Why We Love It: It is totally a free app, on a mission to help partners outsmart money.

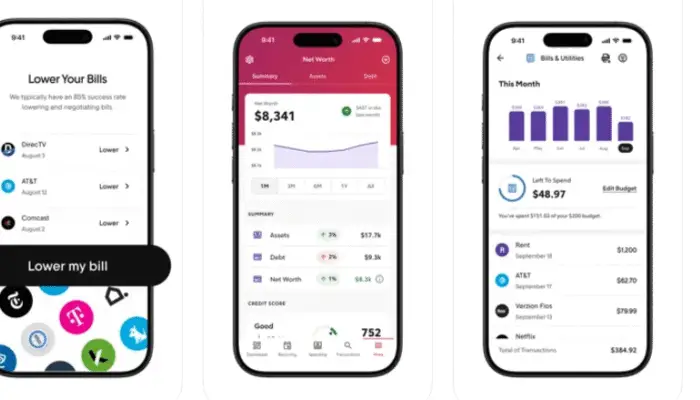

Empower: The Wealth Tracker’s Companion

Empower is an all-in-one app for those who want to track cash flow in multiple bank accounts.

Akin to other budgeting apps, it allows you to track your spending of multiple accounts and credit cards, offering a personalised view of your finances.

Its dashboard highlights your net worth, cash flow, investments, and portfolio performance, making it a powerhouse for wealth-building.

- Cost: Free and $30 per year (30-day free trial)

- Key Features:

- Syncs bank, credit card, and more.

- Displays net worth.

- Retirement planner and educational planner.

- Creates a financial roadmap with the budget planner.

- Who It’s For: It’s best for credit monitoring, spending, tracking, and streamlining savings.

- Why We Love It: Its free tools overshadow paid apps, and its spend tracking is unparalleled for those building long-term wealth.

Goodbudget: The Envelope System Reimagined

Goodbudget brings the classic envelope budgeting method into the digital age.

It syncs with bank accounts and lets you allocate money to virtual “envelopes” for expenses like groceries or rent. While it offers manual entry in the free version, the paid plan includes automatic bank syncing for seamless tracking.

- Cost: Free basic version; Goodbudget Plus is $8/month or $70/year.

- Standout Features:

- Syncs bank accounts (Plus plan).

- Envelope-based budgeting for expense control.

- Shared budgeting for couples or families.

- Debt tracking and payoff tools.

- Who It’s For: Fans of structured budgeting who like the envelope system or need a simple app for shared finances.

- Why We Love It: Goodbudget’s simplicity and focus on intentional spending make it great for those who want discipline without complexity.

Note: The free version requires manual entry, so upgrade to Plus for bank syncing if you have multiple accounts.

Copilot Money: The AI-Powered Money Coach

AI (Artificial Intelligence) is a booming industry that every big company wants to integrate into its system. Similarly, Copilot Money uses AI to make budgeting feel responsive and interesting.

With Copilot money, you can connect multiple banks to a finance dashboard and analyze your Cash flow like a pro.

Its sleek user interface offers a best-in-class experience, allowing users to track spending, budgets, investments, and net worth from a single dashboard.

It’s only available in the United States and supports Mac and iPad.

- Cost: $7.92/month or $95/year (Offers a Free trial).

- Key Features:

- AI-driven spending insights and predictions.

- Syncs bank, credit card, and investment accounts.

- Customizable categories and visual charts.

- Subscription tracking to spot unused services.

- Who It’s For: For users who prefer catchy visuals with smart, personalized tips.

- Why We Love It: Copilot’s AI feels like a personal finance tutor, catching patterns you might miss, like that recurring gym membership you never use.

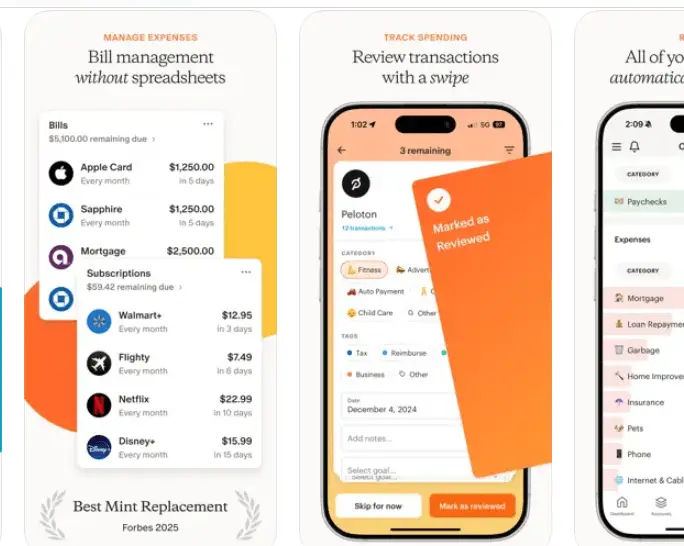

Rocket Money: The Subscription Slayer

Rocket Money (Also Truebill) excels at finding and canceling unwanted subscriptions while tracking your accounts.

Why is monitoring subscriptions underrated? Well, Rocket Money has a different approach.

Not only does it sync with your bank accounts, credit cards, savings, and spending, but it also keeps tabs on your recurring subscriptions.

It gives you full flexibility to cancel your subscriptions while tracking your finances.

And if you want to save some money for your future, this app puts your savings on autopilot after analyzing your habits.

What’s more? Its bill negotiating feature is just a game changer that can help you cut your bills by $500 a year.

- Cost: Basic Free; Premium is $6-$12/month (7-day free trial).

- Key Features:

- Connects with bank, credit card, and savings accounts.

- Subscription tracking and cancellation.

- Bill negotiation to cut costs.

- Intelligent Auto-saving feature.

- Savings goal tracking and alerts.

- Who It’s For: Subscription-heavy users and bill negotiations. Also, it’s the best pick for saving and tracking money.

- Why We Love It: Rocket Money sniffs out forgotten subscriptions and negotiates bills, making it a money-saver from day one.

How to Choose the Right App for You

With so many solid options, picking the best app comes down to your needs and habits. Here’s a quick guide to help you decide:

- Want a comprehensive view? Opt for Quicken Simplifi or Monarch Money. They sync everything—banks, cards, loans, investments—and offer deep insights.

- Need to stop overspending? PocketGuard’s “safe to spend” feature keeps you in check.

- Love proactive budgeting? YNAB’s zero-based system is perfect for planning every dollar.

- Got accounts everywhere? Banktrack’s 120+ bank syncing makes it a no-brainer.

- Managing money as a team? Honeydue’s couple-friendly features are unbeatable.

- On a tight budget? Start with PocketGuard’s free version or Honeydue, then upgrade if needed.

Consider these factors too:

- Ease of Use: Look for intuitive interfaces and fast syncing. Simplifi and PocketGuard shine here.

- Security: All the outlined platforms offer robust security, like biometrics or 2 factor authentication and 256-bit encryption.

- Fee: If you want to test the waters, go for options like Honeydue or PocketGuard’s basic plan.

- Plan: To save money for a future home or pay off bills, you can bank on YNAB or Monarch.

When you want to dig deep or explore the full features of these apps, you can upgrade to a premium plan. However, we don’t recommend upgrading it if free features get your job done.

Few Drawbacks and How to Avoid Them

No matter which app you use, there could be some pitfalls that you must be wary of. Here’s what to watch out for.

- Syncing Glitches: Some apps struggle with certain banks. Test syncing during free trials to ensure your accounts connect smoothly. If not, contact support or switch apps.

- Overwhelming Features: Apps like Simplifi or YNAB can feel like an information overload. Start with basic features (like balance tracking) and explore advanced tools later.

- Security Concerns: Worried about linking accounts? All our picks use secure connections via Plaid, a trusted platform for bank data. Still, enable two-factor authentication and use strong passwords.

- Hidden Costs: Free versions (like PocketGuard’s) often limit features. Check what’s included before committing to a paid plan.

- Manual Entry Hassles: Apps without bank syncing (like Goodbudget’s free version) require manual input, which is tedious. Stick to our picks, which all offer automatic syncing.

Extra Tips for Mastering Your Money

Before we wrap up, here are some bonus tips to get the most out of your chosen app:

- Check Daily: Spend 2 minutes each morning reviewing your dashboard to catch surprise charges or low balances.

- Set Alerts: Use app notifications for bill due dates, low balances, or overspending. PocketGuard and Simplifi are great for this.

- Review Monthly: Look at spending reports to spot trends—like that sneaky $15/month subscription you forgot about.

- Start Small: If budgeting feels daunting, focus on tracking one account first, then add more as you get comfortable.

- Secure Your Device: Since these apps hold sensitive data, lock your phone with a PIN or biometric login to keep hackers at bay.

Wrapping It Up:

Tracking multiple bank accounts doesn’t have to be a headache.

With apps like these, you can see all your money in one place, make smarter decisions, and maybe even have fun doing it.

Whether you’re chasing big savings goals, dodging overdraft fees, or just trying to keep your spending in check, there’s an app here for you.

So, pick an app, start a free trial, and take the first step toward financial clarity.