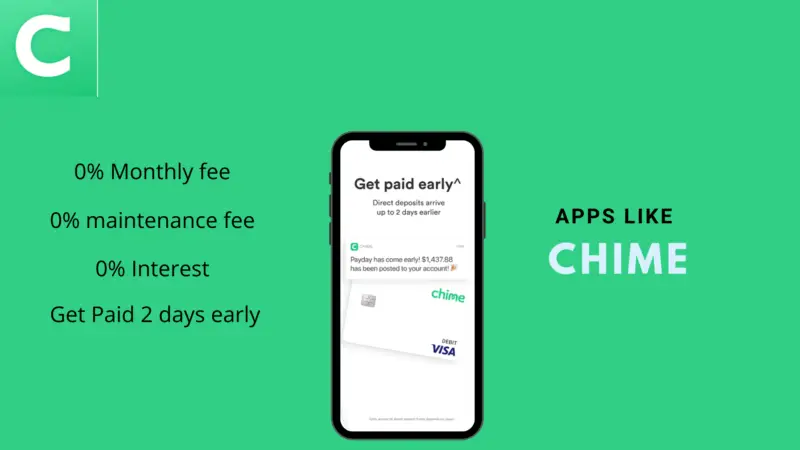

Chime, which started as an investment, is now a full-suite mobile banking company serving over 10 million U.S. users. It provides up to $100 in overdraft protection and pays paychecks up to two days earlier than most stellar banks.

Best of all, there are no hidden fees, no minimum balances, overdrafts, or monthly fees. Also, it is quite flexible as to what it offers, allowing users to control transactions, track budgets, and access more than 38,000+ free ATM stations.

On the flip side, Chime is overcrowded because its customer support is one of the reasons users are switching to other Chime alternatives. That said, when your Chime account is lost or banned, it is nearly impossible to get your account back.

Besides, it has some technical errors that make the user experience much more awful. So, without any further delay, let’s jump right into the best loan apps like Chime.

Best Chime bank competitors ( Top Alternatives)

Ditch overdraft and get a small cash advance of up to $100 between paychecks with Varo Advance. It’s one of the best banking apps for contactless transactions. With Varo Bank, you don’t need to lose sleep over unnecessary fees.

There is a 0% fee for monthly maintenance, ACH transfers, foreign transactions, and at 55,000+ ATMs worldwide. Above all, it has no minimum balance requirement, but make sure your saving account balance is equal to or more than $0.

With Varo, you can receive your paycheck up to two days earlier than most standard banks. It allows you to track your spending, history, or account activity with instant notifications.

Besides, you can use Varo with Google Pay or Venmo for contactless payment as well. Even if the app has advantages, it also has a few downsides; You have to make at least five Visa Varo debit card purchases to be qualified to receive a direct deposit of $1000 or more. And for advances over $20, fees apply.

As per the procedure, to qualify for an advance, your account must be at least 30 days old with at least $0.1 in balance.

- No minimum balance is required.

- No fees.

- Borrow up to $100 between paychecks.

- Instant alerts for every activity.

- Send instant money to Varo users with a note.

- Annual percentage yield (APY) of up to 2.80%.

- No overdrafts.

- Must have at least 30 days old account to get qualified for a cash advance.

Dave is an ultimate banking app that advances up to $200 without any interest or credit check. Launched in 2017, and backed by Mark Cuban, the app has managed to catch the wave in the mobile banking domain. It claims to have saved its customers $200 million in overdraft fees.

Dave provides everyone with intuitive budgeting tools, so they can keep count of their spending and avoid those pesky charges.

As it follows, it lends up to $100 to everyone, and up to $200 to Dave users, with no interest and including other fees.

When you open a direct deposit account with the app, you get your paycheck two days earlier. With Dave, you get access to over 30,000 free ATMs with a money pass. Much like Chime, it doesn’t surprise you with fees.

However, this cash advance app deducts $1 per month from your linked account to leverage its tools, including account monitoring, notification services, debit card, and building a credit history. It also lets users pause or cancel their membership.

- No Atm or minimum balance fee.

- Over 30000+ Free ATMs.

- Intuitive tools to help you with budgeting and monitoring account activity.

- Advances up to $200 with no interest and credit check.

- Fully functional Visa Debit card (Physical + Virtual).

- $1 monthly fee.

- Charges a $4.99 express fee if you want to borrow money within eight hours.

If you want to get up to $100 with your direct deposit, Earnin has your back. Earnin is a community-powered platform where you can show your generosity by giving a tip to fellow members.

With the app, you can receive your money at lightning speed when using a debit card. Moreover, it has tools that help you cash out $100 daily and up to $500 per pay period with no interest – you can tip between $0 and 14, which you think is fair.

What’s best? When you put away $10 in an Earnin’ Savings Jar, you get a chance to win up to $10 million in cash prizes.

To avoid any overdraft, it has a balance shield feature that sends up to $100 of your earnings straight into your account. And it has a financial calendar to inform you about your recurring payments or track your budget.

It also allows you to earn up to 10% cashback when shopping at local or popular spots. It’s the best Chime alternative because it doesn’t charge any fee for using its services or tools. The live chat feature further adds it to the trusted banking apps category.

- Pays up to $100 per day, and up to $500 per day with a max boost.

- 15 million community users can tip one another.

- Sends money with lighting fast speed (may take up to 2 days)

- Live chat support.

- Automatically adds your GPS earnings to your account.

- Intuitive budgeting feature.

- Offers up to 10% cashback.

- No interests, and fees.

- Balance shield feature to avoid overdraft fees.

- Doesn’t pay earlier.

- Work location is required for your job.

Bright is one of the best apps like Chime to get early pay and borrow up to $250 when needed. The app is secure, intuitive, and a one-stop solution to manage your credit score.

Unlike Chime, it doesn’t offer a card service, but it works with more than 15,000+ banks. Just connect your account, and manage all your expenses.

Its intuitive feature notifies users if there is a chance of overdraft or late payments. Not only does it send you real-time alerts, but it also saves you hundreds of overdraft fees in the process.

Besides, it has a flexible repayment option that lets you extend due dates if you can’t pay on your due date. With Brigit, you can earn extra cash by working at a job like Instacart or Doordash.

You would certainly like its budget helper to understand your spending habits every month. And whenever you need an urgent fund, it sends you up to $250 with just one tap without any interest or fee.

However, if you don’t pay back, you won’t be able to borrow money again until you reimburse the last advance fee. To have access to extra financial tools and request cash on time without interest, hop on over to its $9.99 per month plan. Brigit’s basic plan is limited to account monitoring.

- Breaks down your monthly spending.

- Balance alerts and bill alerts.

- Users can extend dates to reimburse a payment.

- No penalties, and no interests.

- Secure and manage credit card scores.

- Automatically sends money to your account to avoid overdraft.

- Supports side gigs.

- Can’t request money with a basic plan.

- $9.99 per month is a bit expensive.

One Finance is a one-stop solution for mobile banking. Whether you want to build credit, save an emergency fund, or track your finances, it has got you covered.

With this application, you can create some significant money goals that move you forward. Unlike its alternatives, One Finance gives you an unlimited 3% APY on your checking account.

And when you set up a direct deposit, you save up to 10% of your paycheck on auto-pilot. Although the app offers a revolving line of credit with a 12% APR, it’s limited to direct deposit customers only.

However, credit builders make payments automatically every month without any separate accounts or cards.

Best of all, the app provides low-cost, flexible overdrafts so your product costs don’t take you to below-zero balances. An overdraft connects to your spending pocket and automatically funds your account when needed.

However, to activate an overdraft, you have to deposit a one-time $20. Overdraft limits may be increased over time for direct deposit members.

- No credit check, no late fees.

- Create and share multiple spend pockets.

- Over 55k fee-free Allpoint ATMs.

- Saves up to $5000 with a 1% APY in Save pocket.

- Offers a line of credit with $12 APR.

- Unlimited 3% APY, One card round-ups.

- Automatic payments so you never miss the beat.

- No saving account support.

- Overdraft avoidance requires a $20 single deposit.

- Users with direct deposits are eligible to qualify for more options and limits.

- Up to 12% APR interest on credit builder loans.

It is one of the best financial online banking apps, founded in 2009. Ally offers an edge over its competitors. It provides early paychecks, auto-home loans, checking and saving accounts, investments, and other financial options.

What’s the catch? It charges fees for using its services. However, there are no monthly or maintenance fees; it only charges for same-day bill pay, returned deposits, and outgoing domestic wires.

Here’s the kicker: Ally has two account options—a savings account and a money market account. Both accounts are free and yield 0.50% APY interest.

A money market account is for checking account members who don’t cash out more than six times a month. You can also start investing and trading with a money market account without any commissions.

What else? You can apply and enroll for a mortgage and an auto loan at affordable interest rates.

- Intuitive budgeting and research tools.

- No monthly fees or minimum balance.

- 0.50% APY on both savings and checking accounts.

- Self-directed trading and Robo advisor.

- Auto bill pays.

- 0% fee trading on stocks, ETFs, Mutual funds, and more.

- Strong web presence.

- No overdraft fees.

- Up to $3000 bonus cash for new Ally investors.

- No ATM access.

- No no-transaction-fee mutual funds

Digit is one of the best personal finance companies that allows users to invest, save, and budget with ease. Founded in 2015, the app has managed to garner over 10 million users worldwide, helping them achieve their financial goals faster.

It analyses your spending patterns with the help of an A.I. to help you save your savings so that you can achieve your saving goals effortlessly.

Worried about an overdraft? Well, it automatically sends funds into your checking account when there is a chance of an overdraft and later deducting from your next paycheck.

Robo-Investing is another great feature the app offers, allowing users to invest only what they can afford.

It creates a diversified investment portfolio as per individual financial and age conditions and automatically moves a part of their income to investment accounts for the long haul.

It claims to have helped its users pay down over $150 in debt and save more than $5 billion automatically.

To get access to all the full options, including investment, overdraft protection, automated saving, unlimited withdrawals, overdraft reimbursement, and no minimum, the app charges a flat $5 monthly from a linked checking account.

It also comes with a 30-day free trial, and then pulls $5 automatically from a connected checking account only after that 30-day period. Unlike other Chime apps, it saves funds in saving accounts that users can use as emergency funds. An average Digit user likely saves up to $2200 each year.

Albert is an amazing app to invest, save, and budget all in one place. It has cutting-edge features to help you reach your financial goals.

This platform is FDIC-insured – meaning – your fund is kept under government protection, and you’re insured for up to $250,000 for any fund loss.

So, regarding security, it ticks all the boxes. Not only does Albert give you peace of mind by giving you insurance and security, but it also offers intuitive features and tools for a better financial plan. Using Albert, anyone can invest in stocks with zero commission.

Its beautiful user interface makes it easier for users to view personalized real-time budgets and puts goals within reach with automatic savings.

It creates a budget for credit cards, college savings, insurance, investments, retirement, debt, and loans.

Best of all, its financial experts can help you in any financial crisis, and you will get personalized advice.

Besides, it notifies users of every status, allowing them to track their spending, Upcoming bills, bank fees, and other activities.

Besides, when you’re short on cash and want an emergency fund, it lends you up to $100 instantly with a $3.99 delivery charge for Genius subscribers and $4.99 for others. There is no delivery charge for standard users, but it takes nearly two days for funds to reach the bank account.

You need to pay at least $4 per month to access the financial advice feature and unlock countless saving goals. To sum up, Albert is nothing sort of any financial aid that helps users achieve a financial goal faster and easier.

| Pros | Cons |

|---|---|

Wrapping it up

We have rounded up some of the best mobile banking apps like Chime that you can try right now to control your financial future. Overdraft fees may not be the problem, but the listed apps are not completely cost-free either.

A few apps may lack support but offer security and tools, and on the other hand, a few apps may offer robust security but lack support and intuitive tools.

These apps may include premium services, although we claim they are free to join. However, if we have to choose, Dave is our favorite pick, and it only costs around $1 per month, which is quite affordable with respect to the tools and features it offers.

Frequently Asked Questions (FAQs)

A. One Finance, Dave, Possible Finance, and Ally Invest are some of the best mobile banks like Chime. Each app offers credit builder loans, early paychecks, savings, and spending accounts.

Yes and no, if ATM access is not important to you. Both apps offer checking and savings accounts with a managed digital banking experience. When it comes to deposits, only Varo Bank allows its users to transfer funds to an external account, while Chime users can only send funds to other Chime users, which is a big bummer.

However, unlike Chime, Varo waives a $5.92 fee for over-the-counter deposits or withdrawals, and there are cash deposit limits. On the other hand, Varo provides joint accounts, while Chime only offers a checking account and a single savings account.

Related article:

When does Chime Direct Deposit Hit? FAQs