You’re out with friends, splitting a pizza, and someone says, “I’ll cover it, just Zelle me later!” Or maybe you need to pay the dog walker before they head out.

Zelle’s your go-to for sending money faster than you can text “done.” It’s a super easy way to move cash between U.S. bank accounts, often in minutes, and usually without fees.

This guide’s got everything you need to start zipping money around like a pro—plus some tips to keep things safe and a few FAQs to clear up any confusion. Let’s barge forward!

What Is Zelle?

Akin to the Cash App, it’s the most popular peer-to-peer payment service that allows you to send or receive cash using an email address or U.S phone number.

It is backed by the giants like Chase, Bank of America, and Wells Fargo, and it’s often built right into your bank’s mobile app or online banking platform.

No need to download anything extra if your bank’s in the game, which is awesome.

What’s more? It doesn’t levy a fee for instant transfer, making it the most useful P2P platform in the U.S.

Launched in 2017 by 30 banks to compete with the major payment services like Venmo or Cash App, has sent over $1 trillion in a single year, outpacing other P2P platforms.

It uses the ACH network (Automated Clearing House) to send funds almost instantly, unlike traditional transfers that take forever.

However, Zelle shut down its standalone app in April 2025, as it was only getting 2% of the total transactions.

How To Send Money With Zelle?

Zelle has removed its app, but you can still set up Zelle through a participating financial institution. Let’s know how.

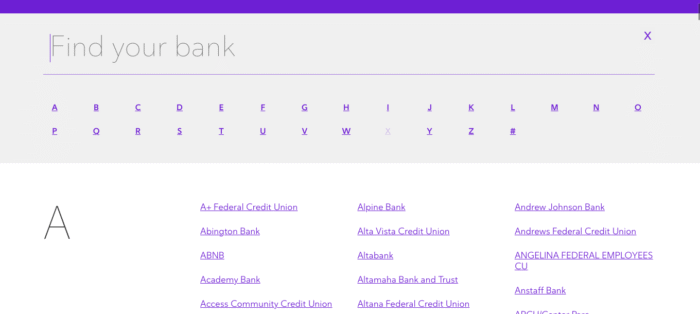

See If Your Bank’s In on Zelle

It works with top banks, including Wells Fargo, JPMorgan Chase & Co., Bank of America, and many others.

So, first check if your bank or credit union offers Zelle to send and receive money.

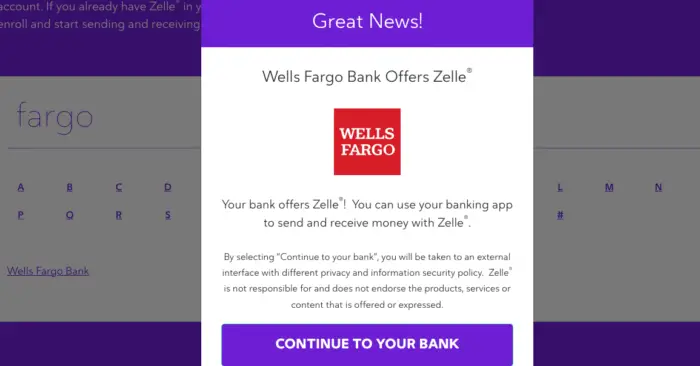

You can head to the Zelle site and search for your bank or credit union. Suppose your bank is Wells Fargo, and it’s on the list of the networks.

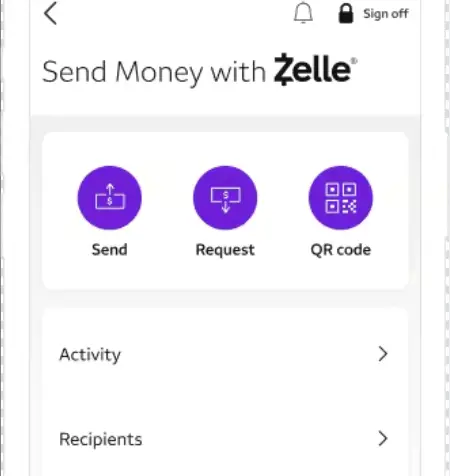

You can find “send money with Zelle“® in the Wells Fargo app or website and pay and get paid between your stored enrolled contacts.

Sign Up for Zelle

You can skip this step if you have already enrolled for it. So, if your bank offers Zelle, you can enroll using your bank account and a U.S. phone number or email address. Here’s how to sign up.

- First off, sign in to your bank’s app.

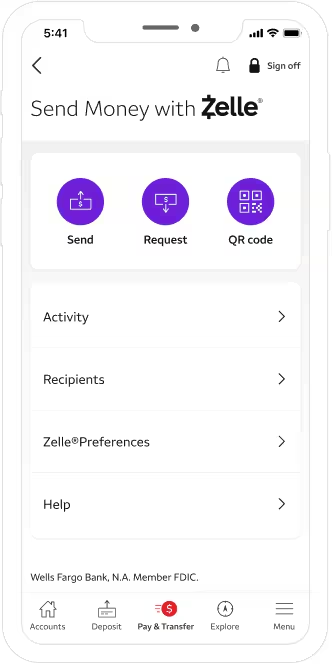

- Navigate to the “Pay & Transfer” section and tap Zelle. Your bank can show something different or a similar name.

- Toss in your email address or U.S. phone number—whichever you think is fair. This is where you’ll get paid by others.

- You will get a one-time code via text or email for verification.

- After verification, you send and receive funds within minutes.

Already signed up with Zelle through another bank? You’ll need to switch your email or phone number to the new bank’s Zelle service.

For example, Navy Federal Credit Union says to call their team at 1-888-842-6328 to make the switch.

Note: You can only tie one bank account to an email or phone number at a time.

Send Money

Ready to use the app for instant transfer? It’s a breeze:

- Open your bank’s app or website and hit up the Zelle section (usually under “Pay & Transfer” or “Send Money”).

- Pick a contact or add a new one by typing their email or U.S. phone number.

- Double-check the recipient’s name—some apps, like Bank of America’s, show a purple “Z” next to Zelle-enrolled contacts.

- Enter the amount, you can add a fun memo like “Cake Party!” and hit “Confirm.”

- Some banks let you schedule payments or set up recurring ones. So you can look for a “Recurring Payment” Option too.

If the recipient is enrolled, the money usually lands in their account in minutes.

If they’re not, they’ll get a text or email with steps to sign up and claim the funds, typically within 1-3 days.

Request Money

Own some cash from someone you’ve helped buy event tickets? You can use Zelle’s “Request” feature:

- In the Zelle section, hit “Request.”

- Choose or add a contact, enter the amount, and send it off.

- They’ll get a notification to approve the payment if they’re enrolled. Note that some banks, like Wells Fargo, only allow you to request money via the mobile app.

Receive Money

When someone transfers cash, it credits into your linked bank account, almost instantly, as long as you’re enrolled.

If you’re not, you’ll get a nudge via text or email to sign up. Make sure the email or phone number matches what’s in your Zelle profile.

If the money’s MIA, reach out to your bank to check your enrollment details.

How To Secure Your Zelle Account?

Zelle’s fast and awesome, but instant transfers mean you gotta be careful.

Once the money’s gone, it’s usually gone for good. Here’s how to keep things secure:

- Store Trusted Contacts. Zelle’s for sending money to people you know, like friends or family. Don’t use it to pay random sellers online—there’s no buyer protection if things go south.

- Verify the Recipient. Before hitting “Send”, ensure you verify the details of the person you’re sending money to.

- Beware of scams. Never fall into a scammer’s trap by approving the payment request. Always verify your contact by calling them.

- Check transfer limits. Banks have their own transfer caps with Zelle. So to know how much cash you can send in a day, you’ve to confirm with your bank.

- Monitor your Account. Check your Zelle activity every now and then for anything weird. If something’s off, contact your bank soon.

FAQs

Q: Can you use Zelle to make payments online?

Unfortunately, you can’t use it to buy stuff online, as it’s primarily for sending and receiving cash among those you trust.

Q: How fast are Zelle transfers?

If you and the other person are enrolled users, you can get cash within seconds. However, it might take nearly 1- 3 days to claim funds for users not signed up.

Q: Does Zelle charge fees?

Since Zelle has no fee structure on its own, you must check with your financial institution to see if it levies any fees.

Q: What if the money doesn’t arrive?

This can get tricky if your recipient is not an enrolled user. Make sure you’re sending funds to the enrolled Zelle user. In case your payment got stuck, you can check your bank’s activity to see if the payment went through.

Q: Can you cancel a Zelle payment?

No, once you make a payment or you hit the send button, it cannot be reversed until the receipt is not signed up. Again, check your payment history to know the status.

Q: Does Zelle work internationally?

No, it is built for U.S citizens who have a U.S phone number and a bank account or credit card.

Wrapping It Up

Zelle’s like the superhero of money transfers—fast, easy, and usually free. Whether you’re splitting dinner, paying a friend, or sending cash to your sibling, it’s got you covered.

More than 2200+ banks have incorporated Zelle to send and receive money to bank accounts.

With over 150 million enrolled users, it’s one of the most trusted apps for sending and receiving money within the U.S.

Unlike its rivals, it doesn’t charge for using instant transfer, which is quite a cool aspect of any P2P apps.

So, before sending a payment, ensure your recipient is an enrolled Zelle user, so your payment goes through smoothly.