You’ve recently purchased a shiny new drill or a fancy fridge from Lowe’s, thanks to your trusty Lowe’s Credit Card.

The MyLowe’s Rewards Credit Card, issued by Synchrony Bank, is like a DIY superhero, swooping in with a 5% discount on eligible purchases or sweet financing deals for those big projects.

But, like any superhero, it comes with a catch—paying the bill on time to avoid rippling late fees and interest charges.

Don’t worry, this guide’s got your back with a step-by-step breakdown of how to make your Lowe’s Credit Card payment like a pro.

Lowe’s Credit Card Payment: Options

Let’s be real—nobody wants to get slapped with a late fee or see their credit score take a nosedive.

Paying your Lowe’s Credit Card on time keeps your wallet happy and your credit in tip-top shape.

With a standard APR of 31.99%, it’s smart to stay on top of payments.

Whether you’re a shopaholic on weekends or a deal grabber, here’s how to handle those payments smoothly.

Pay Online

Paying online is like ordering pizza with an app—fast, easy, and you don’t have to talk to anyone. Here’s how to do it:

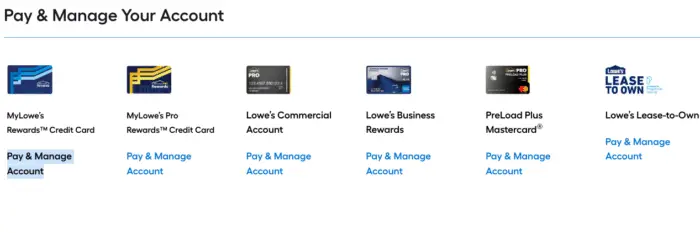

- Visit The Website: Navigate to lowes.syf.com, scroll down till the “Pay & Manage Your Account” section, and choose your credit card to manage your account. To guide you, we’ve clicked on the MyLowe’s Rewards Credit Card.

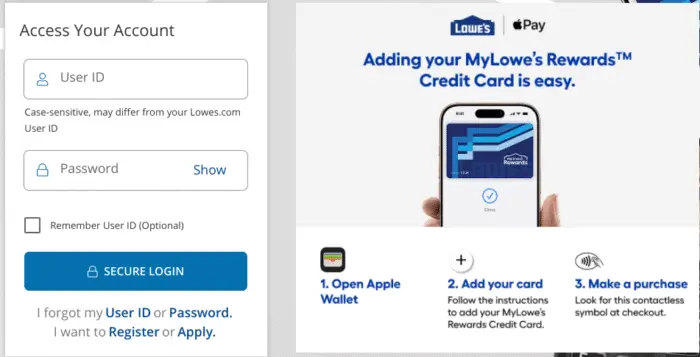

- Log In or Pay as Guest: Got an account? Enter your username and password, then hit “Secure Login.” New User? Click “Register” to set up your account. You can also Pay As Guest if you’re not willing to register.

- Navigate to Payments: Once logged in, find the “Payments” tab on your dashboard. It’s like the GPS for your money.

- Choose Your Amount: Enter your payment details, choose the amount, and select a date. You can set an automatic payment, and you don’t have to pay yourself every month.

- Confirm and Pay: Once you’ve selected the amount and date, just tap Pay.

Note: Online payments are really quick, but setting up autopay will always work in your favor.

Pay by Phone

If you want to go for an old-school way, a phone can help you pay your credit card bill without even touching the Internet.

- Dial Up: Got the card? You can find the toll-free number printed on it. It’s usually 1-800-444-1408, and when you make a call, an automated Synchrony system will speak.

- Follow Through: You’ll be asked to enter your card info, then choose the desired amount you want to pay. Simply go through all the steps to pay your Lowe’s credit card bill.

Pay by Mail

If you’re an avid fan of envelopes and trusting the postal service, paying by mail is the best choice. Here’s the deal:

- Write a Check or Money Order: No cash? You can write your credit card number on the check or money order.

- Mail It To: Send it to Lowe’s Advantage Card P.O. Box 669807 Dallas, TX 75266-0759

- Time It Right: Mail it early enough to arrive by the due date. The post office isn’t known for its speed, so don’t cut it close unless you’re feeling lucky.

Pay In-Store

Next time you’re at Lowe’s picking up yet another can of paint, swing by the customer service desk to make a payment.

- What You Need: Bring your credit card or account details. Cash, check, or money order works here.

- You’re done: Hand over your payment, get a receipt, and you’re done faster than dialing a number.

A Few Tips To Consider

Paying your bill is one thing, but doing it like a financial ninja is another. Here are some tips to make your Lowe’s Credit Card life easier:

- Set Up Alerts: Enable account alerts for due dates, balance changes, and promotions. It’s like having a personal assistant.

- Pay More than the Due: When you pay the Due or a minimum payment, you don’t actually pay off your bill; you’re just keeping it for a longer duration. So instead, pay more than the minimum balance to get rid of that 31.99% APR.

- Monitor Spending: Checking transaction history every day might be frustrating, but it’s actually a lifesaver. It can help you find out transactions done by mistake.

- Understand the Financing: Those 6-month or 84-month financing deals sound great, but they’re deferred-interest offers. If you don’t pay off the full balance by the end of the promo period, you’ll get hit with interest from day one. Read the terms like it’s a treasure map.

Lowes Credit Card FAQs

Got questions? We’ve got answers. Here are the most common queries about Lowe’s Credit Card payments.

Can I pay my Lowe’s Credit Card with a gift card?

No, you can’t pay off your Lowe’s credit card bill with a gift card, which is a caveat we think. However, it offers a host of great options like a bank account, call, check, and money order.

Does it charge a fee for a missed payment?

Missing a payment can cost you a few dollars and a mark on your credit score. So set up an autopay to save your hard-earned money..

Can I combine the 5% discount with financing offers?

Sorry, you have to pick one: the 5% discount or a financing offer like 6 months no interest on purchases over $299. You can do the math to see which saves you more.

Is there a way to avoid late fees?

There is no such hack but to set up automatic payments and pay in chunks for bigger purchases. If you don’t spend recklessly and manage your cash with full discipline, you can avoid late fees.

How do I contact customer service?

Simply head over to the Synchrony Bank account online to contact customer support, or you can directly call at 1-800-444-1408.

Can I make a payment before my bill arrives?

Yes, you can pay off your debt prior to your statements arriving. Simply log in to your online account or call to make a payment anytime.

What’s the deal with the 20% off for new accounts?

It’s nothing but a perk that cardmembers get for making their first purchase using a Lowe’s card- That’s a 20% discount, up to $100.

Wrapping It Up

Paying your Lowe’s Credit Card doesn’t have to feel like assembling furniture without instructions.

It’s your choice how you want to pay off your bill: online, by phone, mail, or in-store.

All things aside, you just need to be careful about late fees and ensure you set up alerts and autopay to pay on vain.

As to rewards, with 5% discount perk, you can enjoy financial deals without the stress.