No matter whether it’s a new year, black Friday, or any other normal day, shopping doesn’t stop. If you’re splurging your cash on Kohl’s store throughout the year, you must be using a credit card, right?.

But if you don’t, you must enroll for a Kohl’s credit card for extra perks that other cards don’t offer.

However, if you’re already using the Kohl’s card but don’t know how to make a payment, you’ve stumbled upon the right place.

As we know, paying off bills on time not only boosts a credit score but also keeps us from unnecessary worries that degrade our lives.

So, without any further ado, let’s jump right into the article.

How To Make A Kohl’s Credit Card Payment?

Before you end up piling up a late fee, let’s know how to pay the bill. I’ve rounded up four easy ways so you can choose what fits your needs.

Online

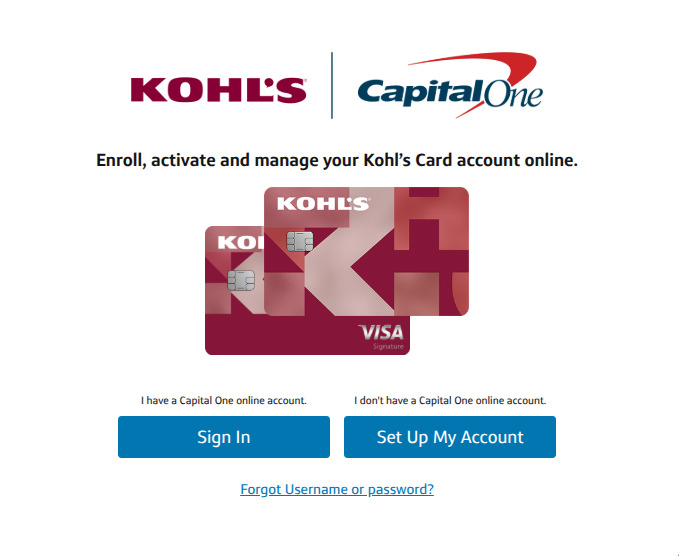

It’s the easiest, fastest, and most convenient way that only requires an internet connection and a device. You need to have a Capital One account to manage your Kohl’s card account. So let’s break it down step by step.

- Head to the kohls.capitalone.com website. You can also use any popular Search engine to navigate the site.

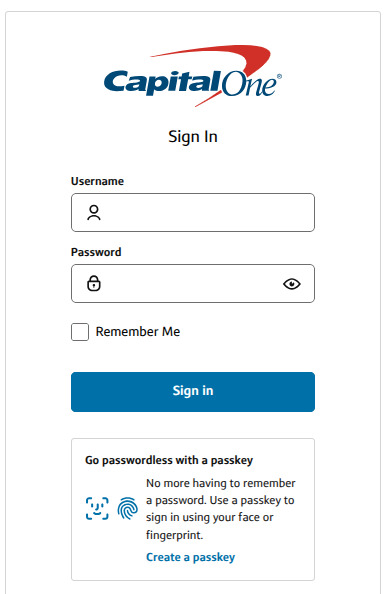

- Next up, tap “Sign in”, and you’ll be redirected to the verified.capitalone.com website.

- Now enter your Username and Password that you’ve created during the enrollment process. Forgot? You can find your Kohl’s username here.

- So once you’ve entered your credentials successfully, you can access your account, check your balance, increase your credit limit, or pay your bill.

In-Store

If you want to handle things without the internet, this method is all you need.

Since Kohl’s stores don’t accept credit cards, you have to carry cash, a debit card, or a check and ask an operator at a counter to help you make a payment.

They will look into your account and move funds from their store account almost immediately.

Best of all, you don’t have to bring physical cards with you; simply an account number will work.

However, it’s best to come prepared for a smooth process. You must visit a store during office hours, so you can speak to someone at a desk.

By Mail

This must not be your favorite, but it’s the traditional way to pay bills. However, in this fast-paced world, it doesn’t fulfill the needs of people, as it takes days to complete a payment.

So, I don’t recommend choosing it over any other methods. But if you want to explore it, you have to mail it at least 10 days before the due date to avoid late fees.

To send a payment via mail, all you need to do is write a check and send it to the correct address. Ensure it has no cash and more than one coupon.

Just include your Kohl’s credit card account number and the payment coupon, and send it to the address:

Kohl’s, P.O. Box 3043, Milwaukee, WI 53201-3043.

Via Phone

Don’t want to pay in person or online? Then this option is for you. If you have the card number and bank account, you can easily pay your bill by calling 1-855-564-5748.

Just answer the automated call prompts till a representative connects with you to help you make a payment.

There is no fee attached to it, but compared to online, it takes nearly 2 business days to post a payment.

However, it is so helpful when no store is open and the internet is down.

What is Kohl’s Credit Card?

The Kohl’s card is issued by Capital One, N.A., built for Kohl’s shoppers to rack up discounts and other rewards.

It’s a store-only Visa card that offers up to 7.5% cash back and discounts every day on shopping at any Kohl’s store.

Besides, you get up to 3% cashback outside Kohl’s or at merchants that accept Visa.

So, when you recharge a gas at any fuel station, you get a 3% Cashback. And 2% for shopping at grocery stores like Walmart, or any discount store or superstore.

And every cardholder can rack up 1% discount every time, anywhere that supports Visa.

What’s more? Its cardholders get a monthly free shipping for spending $600 at Kohl’s stores in a calendar year.

On top of that, if you’ve recently received your card in the mail, you can make use of its 40% discount coupon within 30 days: it’s valid for new users.

When it comes to the fees, it charges around 29.99% APR and up to $40 in late fees.

However, it has no annual fee, but levies 4% transaction fee for each transfer and a 5% for cash advances.

A Few Tips To Avoid Fees

If you’re already aware of this, you can fly off this article. As we know, paying a credit card bill is not only good to avoid penalties, but it’s also necessary for our mental health.

A single payment missed can ruin our day, so it’s vital to stay on top of your Kohl’s credit card.

Here we’ve outlined a few tactics that you can use to streamline your payments.

Set Reminders

How often do you remember your deadlines? Well, 7 out of 10 people don’t set reminders on their phone or calendar for the due date, resulting in missing payments.

So to avoid late fees, you must set a reminder so you can receive a notification before the due date.

Pay More Than the Minimum

Just settling the interest or the minimum payment cannot get you out of the credit card debt.

Since it’s a debt that you need to reimburse to avoid the interest piling up gradually.

So, ensure that you pay a little extra every month to avoid interest charges as high as 29.99% APR.

Check for Promotions

Like Rewards? Kohl’s offers cashback and discounts during many special events. So by leveraging such perks, you can save a lot of cash in a year and offset the balance.

So, keep tabs on the company’s promotional emails to grab such deals.

Monitor the Account Regularly

You don’t need to monitor your account if you’ve enabled notifications for transactions. However, if you access your account sporadically, you can catch any issues soon.

In case you find any problem, you can dispute a charge. For instance, if your payment is deducted from your bank account but does not show in the Kohl’s transaction, you can report it to the support team to avoid unnecessary fees.

What to Do If a Payment Is Late

It can hurt your credit score and incur a $40 fee. However, missing a payment is not illegal, but it is assumed to be a bad practice, as it can affect your credit score.

But if your account is in good standing, you can explain your situation to the Kohl’s support team. They’ll charge a one-time courtesy fee, as it will prevent your credit score from further damage.

Best of all, you can set up a reminder or, even better, set up Auto-pay to avoid falling into this situation.

Frequently Asked Questions (FAQs)

We’ve outlined four ways to make a payment: online, by phone, in-store, and by mail. You can opt for any one you find useful and convenient.

If you have no time to settle bills, you can set up Auto-pay to pay your balance automatically.

You need a Capital One Online Account to use Auto-Pay. Simply navigate to the “Auto-Pay” settings and set a custom or full balance to draw from your bank account.

To avoid a transaction failure, make sure you have enough funds in your bank.

Yes, it levies up to $40 after 25 days of the billing cycle. You can avoid this by paying a minimum balance at least 7 days before the due date.

However, if you pay in full on time, you can also cut the interest charges.

Visit any Kohl’s store during open hours, and navigate to the cash counter. You can ask a cashier to pay your credit bill using your debit card or cash.

It’s a common issue that most users face during transactions. However, the most common reason could be an incorrect username or password. Also, ensure that you’ve activated your card after the enrollment process.

Another reason could be a wrong merchant, or you’re trying to check out at stores that don’t accept Visa.

Wrapping Up

Did you enjoy the read? I hope you’ve understood the gist of the article: Making a Kohl’s payment the right way.

Well, making a payment is easy, but paying on time is what matters most.

If you take notes from this article and follow the process, you won’t skip a single payment.