Got a Car? You must be spending cash to maintain it. Having a car is like having a pet that needs constant care. However, with the help of the Firestone Credit card, you can finance your auto parts, tires, and more.

Well, you must be using the card already, right? If you’re a newbie, and trying to figure out how to make a payment or pay your bill, you’ve come to the right place.

So without any further ado, let’s jump right into the article.

Why the Firestone Credit Card?

First off, why do you love this card? It’s built for car enthusiasts. Issued by CFNA and backed by Bridgestone.

It works at Firestone Complete Auto Care, Tires Plus, Wheel Works, and tons of other auto shops across the country.

There’s a private-label version just for these spots and a Mastercard version that you can use anywhere Mastercard is welcome.

Best of all, it has no annual fee, offers sweet promotional financing on purchases of $149 or more, and has perks like discounts or rewards—like a $100 prepaid card when buying four eligible Bridgestone tires, making it the best deal.

But to keep those good vibes going, staying on top of payments is a must.

4 Ways to Make A CFNA Payment

Paying the Firestone Credit Card bill is super flexible, with options that fit different styles. Let’s dig into it:

Via Online

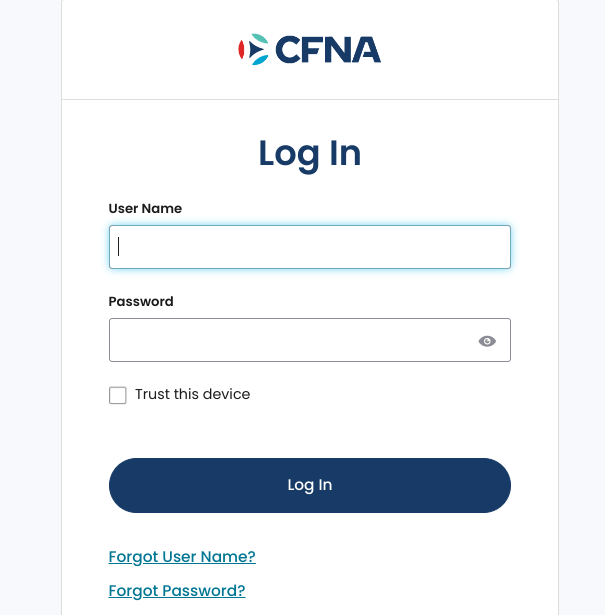

The easiest way to pay off your CFNA bill is online at CFNA.com or through the myCFNA Mobile app (available for iOS and Android). Let’s break it down into a few steps.

- Create Account – First off, create the CFNA account (Ignore if you already have one).

- Log in – Next Up, sign in to your CFNA account using the username and password you’ve created during the registration process.

- Check your Balance – Once you’re in the dashboard, you’ll see your balance, including other options like statements, due balance, and more.

- Make a Payment – If you confirm you’ve an outstanding balance that you need to pay. Simply, head to the Payment section or the Make a payment option you’ll find in the dashboard under the main menu. Tap to ap to start the payment process, and follow the prompts.

It’s worth noting that there are no automatic monthly payment options, so you’ve to set them up on your own.

Via Phone

Not big on apps? No problem. Call the number on the back of your card—1-800-321-3950 for the private-label card or 833-402-1481 for the Mastercard.

A friendly customer service representative will be on the call, and there’s a $4.95 fee for this service.

The automated system won’t take those cards, so you’ll need to chat with a person.

Payments before 11:59 p.m. EST hit your account the same day, making this a quick fix for last-minute payments.

Via Mail or Money Order

For those who love the old-school vibe, mailing a check or money order works too.

Send it to the address:

CFNA, P.O. Box 81344, Cleveland, OH 44188-0344

Include the payment coupon from your statement to make sure it’s credited correctly.

No coupon? Just jot your account number on the check. Payments need to arrive by 5 p.m. EST to count for that day, so give the mail a few days to do its thing. It’s reliable but takes some planning.

Scheduling Payments

Got a busy schedule? You can set up to six payments in advance through CFNA’s online portal. It’s a great way to plan around paydays or big expenses.

Some users have faced difficulty making a payment, like payments not going through or being capped at the last statement balance for security reasons.

If that’s the case, you can reach out to the customer support via phone or email, and let them fix the issue.

Firestone Promotional Credit

The card’s six-month deferred interest deal on purchases of $149 or more is a big reason people sign up.

It’s awesome for pricey things like new tires or major repairs—no interest if you pay it off within six months.

But here’s the kicker: if you don’t clear the balance by the end of that period, you’ll get hit with interest from day one at a steep 34.990% APR.

To avoid that, pop a reminder in your phone for the promo period’s end date and aim to pay it off early.

Payments go toward smaller, non-promotional balances first, but they shift to the promotional balance within two billing cycles of the period ending, helping you avoid that interest trap.

How To Avoid Late Fees?

Nobody wants to go through late fees or affect their credit score. CFNA charges up to $29 for late payments, and if you’ve missed minimum payments in the last six months, that jumps to $40.

On top of that, late payments get reported to major credit bureaus, which can impact your civil score.

So, pay at least the minimum 4.4% of your balance by the due date to avoid late fees.

Also, you don’t get trapped, check your statements every month, and set up notifications or calendar alerts to keep track of your due date.

However, sometimes, payments can get stuck. In such a case, contact the customer support team via phone or email at CFNACustServ@CFNA.com.

CFNA Rewards

The Firestone Mastercard loads with a rewards program that’s pretty cool.

You earn points based on spending tiers—starting at three points per dollar at Firestone locations for the Passenger tier ($1,250 annually).

Higher tiers like Driver and Adventurer bring extra points and perks, like birthday rewards.

Your points convert into reward certificates for statement credits and expire after six months.

However, if you don’t want to lose such points, ensure your card is active.

You can keep your card active by spending on little things like tire rotation, as those small purchases not only keep your card active, but also boost your score.

A Few Tips To Remember

Want to make this card work like a charm? Try these:

- Turn On Alerts: Use the myCFNA app for reminders about due dates and balances.

- Pay Early: Beat the deadline by a few days, especially if mailing payments.

- Watch Promo Periods: Mark those six-month deadlines to avoid surprise interest.

- Contact Support: If payments failed or you’ve got an issue, call or write to CFNA, P.O. Box 81315, Cleveland, OH 44181-0315.

- Explore Other Cards: If the high APR or no autopay bugs you, check out cards that offer 21 months of 0% APR on balance transfers.

What If Things Go Wrong?

Well, maybe you overpay or miss a due date. For statement errors, file a dispute within 60 days via the CFNA website’s “Card Services” form or by mail.

If you lost your card or encountered an unauthorized transaction, contact us immediately to limit liability to $50.

Also, you shouldn’t be frustrated if you experience slow refunds or poor customer service, as sometimes responses may be slow due to busy deadlines.

In case your account closes after three years of inactivity, you should not panic about your credit score, but it can impact your credit utilization.

A small purchase now and then keeps the account open and healthy.

Wrapping It Up

The Firestone Credit Card is like a trusty toolbox for car expenses, with awesome perks for repairs and tires.

The only drawbacks we found are no automatic payment and high APR for missed payments that can aloof people.

However, using the right payment strategy, you can stay on top of late fees or due dates and upgrade your credit score.

Also, setting up scheduled payments or maintaining card status can help you go a long way.