Sending money overseas is now so streamlined and fast – you don’t need to travel across borders and have to break the bank.

However, with every growing economy and inflation, transferring cash with a low conversion fee is still a huge challenge.

Especially, if you’re a student studying abroad and want to pay off your fees, or you’re a freelancer who is looking for the lowest exchange rate service.

There could be several reasons why you’re scouring the best international transfer platform with the lowest conversion fee possible.

So, in this article, we’ll dig into the best services, as well as learn some practical tips and tricks to keep your wallet plump. Let’s dive in.

Why Cheap International Money Transfers Matter?

Moving money across borders can feel like navigating a minefield of hidden fees, hefty exchange rates, and slow delivery.

Standard banks are surely not the best way to send international money, as they levy hefty charges as high a 7% of your transfer amount.

While conversion fees may be far from the real market rates, this makes traditional banks a less favourable option for overseas payments.

So moving your money across borders feels like a pinch. Whether you’re a digital nomad working from Bali or a student studying in Asia, it’s not easy to find a good service that offers cost-effective transfers.

However, with the advent of fintech platforms, the competition has made money transferring a bit easier, thanks to technology.

Cheap Ways To Transfer Money Overseas

Don’t panic, if you’re looking for some serious platforms that offer great services and have the lowest fee structure, we’ve got your back.

Transfer Money Online

Platforms like Wise, Remitly, and Revolut are not hidden from their best-in-class service.

Not only do they provide a seamless user experience, but they also offer very competitive exchange rates with transfer fees.

On top of that, you won’t experience a delay in transferring your cash, which is quite a headache these days.

Best of all, they support more than 70 countries, and all you need to do is open the app or website to send cash at your fingertips.

Wise

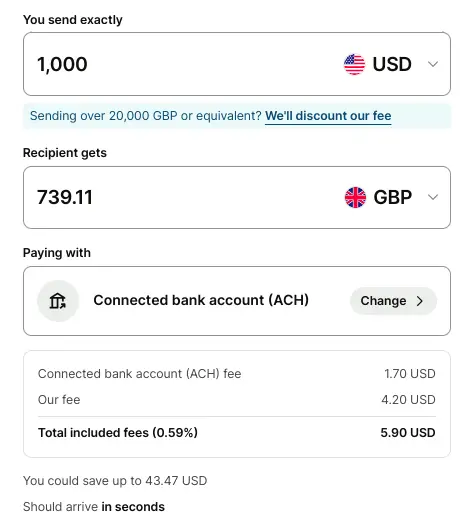

The most popular name among international money transfer services that offers the lowest exchange rates of as low as 0.1%. It’s the most friendly platform that is available on all cross-devices, making it the most convenient option for sending cash out.

It supports up to 50 multi-currencies in real-time with no hidden charges. You can also compare your fees with banks your country supports.

The maximum amount of cash you can move in a bank per day is $50,000, and $2,000 if you use a debit or credit card. And if you want to send a large amount of cash every day, that is $1 million.

Revolut:

It’s another platform that offers competitive exchange rates and supports more than 25 currencies across 120 countries.

So, for global transfers, it’s the best choice among travelers and expats who want to travel fee-free on weekdays.

Apart from sending cash globally, it lets you split bills and keep track of spending, while saving you up to 35% on opening a savings account with them.

However, there are premium perks that you can explore to save more money and get the most out of Revolut.

We forgot to mention that it is one of the fastest and cheapest international money transfer services, and it is trusted by over 55 million users worldwide.

OFX:

A heavyweight for larger transfers, OFX offers zero fees for transfers over $10,000 and exchange rates that beat most banks.

It’s ideal for business owners, property buyers, or anyone moving big sums to 190+ countries. OFX also provides 24/7 support and tools like forward contracts to lock in rates, giving you peace of mind.

Akin to other platforms, it can be a one-stop solution for your business, offering loads of top-notch services to streamline your business.

It has moved over $200 bn over the years, making it one of the most trusted platforms, with competitive exchange rates.

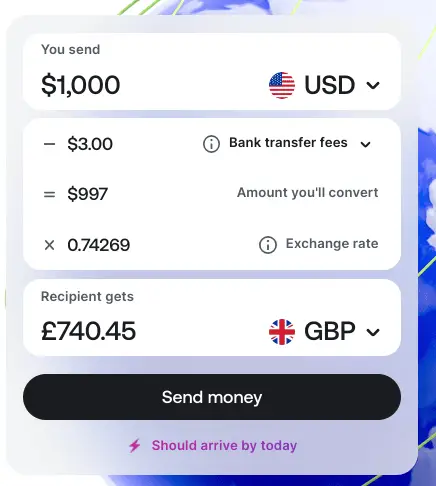

Remitly:

If late transfers bother you, Remitly’s Express option delivers funds in minutes for a slightly higher fee, while its Economy option keeps costs low for non-urgent transfers.

It’s great for sending to countries like India, Mexico, and the Philippines.

However, it supports almost every country, except Taiwan, Venezuela, Macau, the U.S Virgin Islands, and a few more.

Unlike its rivals, it’s mainly Money transfer oriented, as it doesn’t offer other services like tracking spending or business support. So if you’re a new user, you can rack up its promotional rate.

Peer-to-Peer (P2P) Platforms

Got a PayPal account? You can use Xoom to exchange cash in different countries. It provides the best exchange rates and low fees compared to standard banks.

P2P services like CurrencyFair and Xoom can cut costs dramatically compared to typical banks. Think of it as a global barter system for cash.

CurrencyFair:

This platform is another international money transfer that offers fair exchange rates and a low fee.

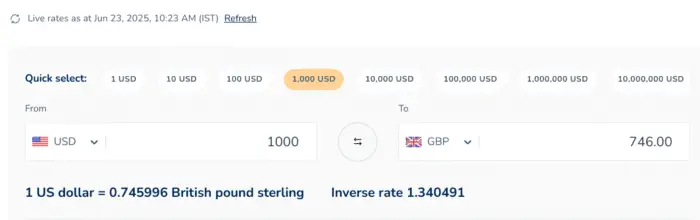

When you use CurrencyFair, you can save up to 4.73% for transferring $1000 to GBP.

Best of all, it lets you set your own rate and wait for a match, giving you control over costs. It has no hidden fees, and it supports more than 20 currencies.

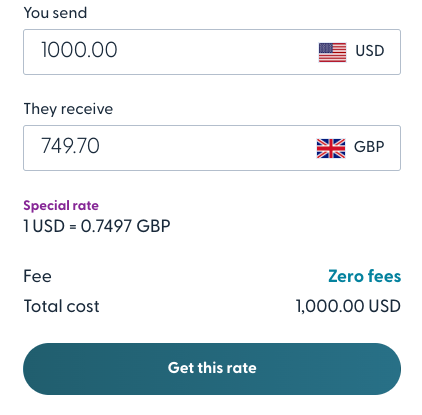

Xoom:

PayPal’s Xoom service is a solid pick for smaller transfers, with low fees for bank deposits and cash pickups in 160+ countries.

It’s super handy for urgent transfers to places with limited banking access. At present, if you send $1000 to British pounds, the receiving amount will be 717 GBP. (734 the real rate)

Note: Before moving your cash, make sure you choose the right deposit method to leverage fair exchange rates and low fees.

Cryptocurrency

Back in the days when crypto was deemed the most volatile currency, but now it has gained popularity and trust over the years.

Platforms like Coinbase and Binance let you convert cash to USDT or USDC (pegged to the dollar) and send them instantly to a recipient’s crypto wallet.

They can then withdraw to their local currency at a flat fee and fair exchange rate.

- Best for: People can use crypto to send cash to countries like Argentina or Nigeria, where either exchange rates are higher or no service is available.

Note: Some countries may have strict regulations, so check your local laws before involving Crypto to transfer cash.

Traditional Banks

You’ve to rely on typical banks for big-ticket transfers, such as buying a property or paying off college fees.

You can open an account at banks like Chime, Starling, or Monzo that levy lower fees than the popular traditional banks.

Make sure that whatever bank you choose works with overseas banks and has low fees and fair exchange rates.

One of the best banks you can go for is Starling, as it has no fee for international transfers and offers competitive rates.

Why Banks: Fintech platforms like Xoom or OFX are still good for transferring serious cash at once. However, if the amount is larger, banks are secure and trusted.

Prepaid Debit Cards or Multi-Currency Wallets

The other way around is Multi-Currency Wallets like Payoneer or Skrill. You load money in currency and cash out in another, at better rates than typical banks.

Since such platforms offer a prepaid debit card, it’s the best choice among nomads or freelancers working with global clients.

Payoneer:

It’s ideal for business owners who get paid by clients in different currencies and withdraw cash in their local currencies.

Normally, it offers a base fee rate for each transfer, with a fair exchange rate. With its debit card, users get many perks when travelling abroad or shopping around.

Skrill:

It’s the best option if you want to get paid cheaply and instantly in your local currency or shop online using a Skrill Visa® Prepaid Card.

It has lower fees compared to other platforms listed here, and offers support for your business to get paid in 40+ currencies.

Why it works: These cards act like a buffer, letting you lock in exchange rates and avoid multiple conversions.

Tips to Save Fees on Overseas Transfers

Want to stretch your dollars (or euros, or pounds) further? Here are some insider tricks to keep costs down:

- Compare, compare, compare: Use comparison sites like CompareRemit or MoneyTransfers.com to pit providers against each other. Fees and rates change daily, so don’t settle for the first option.

- Time your transfer: Exchange rates fluctuate. Watch the market using apps like XE or OANDA, and transfer when your currency is strong.

- Avoid cash pickups: Cash pickups can be expensive compared to bank deposits, so only opt for them when it’s urgent.

- Find Promotions: If you’re sending cash for the first time, a promotional discount can save some cash. Always try to sign a deal before initiating a transfer.

- Send at once: To avoid pesky flat fees, try to bundle your payments and send a larger amount instead.

Few Things to Consider

Even the best methods come with pitfalls. Stay sharp to avoid these common traps:

- Hidden fees: Don’t fall for no-fee advertisements, as some platforms may hide fees and offer poor exchange rates.

- Scams: Scams are everywhere; ensure you use a regulated fintech company that shows a genuine fee structure.

- Delivery delays: If you want an instant payment, you may choose an option for instant delivery; otherwise, it may take 1-3 days to reflect a payment in an account.

Summing It Up

Things have changed dramatically with overseas payments over the years. Now, sending money globally doesn’t cost an arm and a leg.

People now tend to rely on modern Fintech platforms rather than traditional banks that charge a hefty fee. However, banks are also not completely extinct, as sending large amounts of cash is still a huge problem with new-age platforms.

You can easily transfer up to $10000 per day using Wise, OFX, or Zoom. Or use wallets like Payoneer that back a multi-currency account.

So, we’ve rounded up all the cheap options, whether you’re transferring funds to your loved ones you kicking off a global business.