Got that shiny Target Circle Card (the one that used to be called the RedCard) and wondering how to keep those payments on track? No stress—this guide’s here to walk you through it.

Whether you’re using the credit card, debit card, or reloadable version, paying it off is super easy once you know the ropes.

This article covers all the ways to pay, tosses in some practical tips, and keeps it real so you can focus on scoring those Target deals. Let’s dive in!

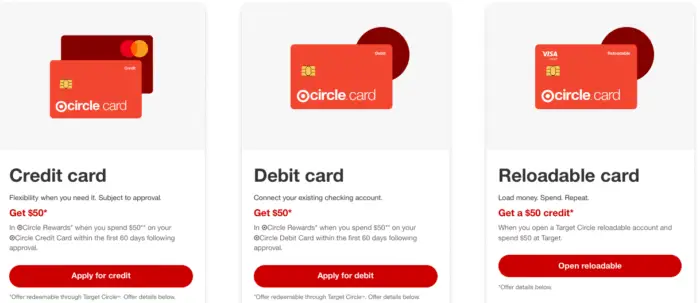

What’s the Target Circle Card?

First things first, let’s talk about what the Target Circle Card is. It’s Target’s loyalty card that hooks you up with 5% off every purchase, free shipping on most online orders, and extra time to make returns.

It’s it awesome? There are three flavors: the credit card (backed by TD Bank USA), the debit card (tied to your bank account), and the reloadable Visa or Mastercard that works anywhere those cards are accepted.

Knowing which one you’ve got is key since payment methods differ a bit depending on the type.

How To Make A Target Card Payment?

Making a Target Red Card payment is as straightforward as it may seem. There are a host of ways to pay off your bill, including online, app, In-store, phone, and mail.

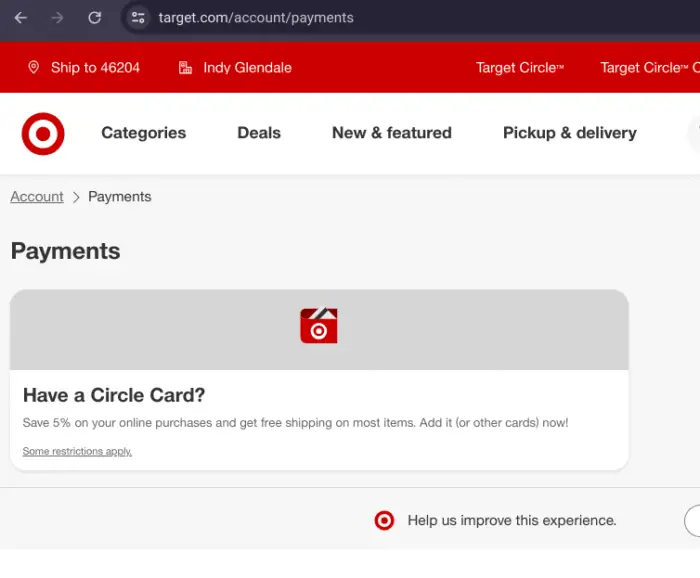

Pay Online

Paying online is hands-down the easiest way to settle your bill. It’s quick, secure, and you can do it while binge-watching your favorite show. Here’s how it goes:

- Navigate to Target’s Website: Launch your browser (Chrome or Safari) and head to Target payment page.

- Sign In: Log in to your Target account. If you don’t have one yet, set it up with the email linked to your card.

- Tap Payment Section: Once you’re in, head to the payment section. Add your card and hit save. Credit card holders will see their balance, due date, and payment options right there.

- Enter Credentials: Pick whether you’re paying the minimum, the full balance, or something in between.

- Hit Submit: Review everything, click submit, and you’ll get a confirmation. Save or screenshot it in case you need to show it.

Tip: Set up autopay to make life easier. You can choose to cover the minimum, the full amount, or a custom number each month.

It’s like having your bills pay themselves while you sip coffee.

Via Target App

Always glued to your phone? The Target app is your new bestie. It’s like having a tiny Target store in your pocket. Here’s the deal:

- Download the App: Get the Target app from the App Store or Play Store and install it on your device if you haven’t already.

- Log In: Access your Target account details.

- Access Your Card: Tap “Wallet” or “Target Circle Card” to check your account.

- Make a Payment: Hit “Pay Now,” pick your amount, and add a bank account if it’s your first go. Tap submit.

- Confirm: Make sure you get a confirmation saying your payment has been successful.

The app’s awesome for quick balance checks or setting payment reminders. It’s so easy, you’ll wonder why you ever did things any other way.

Pay In-Store

More of an in-person kind of person? You can handle payments right at a Target store. Here’s how:

- Visit Target Store: Go to the Guest Services counter, usually near the front or by the checkouts.

- Bring Your Info: Have your Target Circle Card or account number handy. Credit card payments can be made with cash, check, or debit. Debit card payments happen automatically, but you can top up a reloadable card with cash or debit.

- Chat with the Team: Tell the Guest Services crew you’re there to make a payment. They’ll pull up your account and take care of it.

- Get a Receipt: Always ask for a receipt to confirm everything’s good.

Don’t land on the peak hours if you want to pay in-store without waiting in a queue.

Pay via Mail

Feeling a bit old-school? You can still mail a payment for the Target Circle Credit Card. Here’s the lowdown:

- Check Your Statement: Your monthly statement (by mail or email) comes with a payment coupon and the mailing address.

- Write a Check: Make it out to Target Corporation and jot your account number on the memo line.

- Mail It Early: You should send it at least 10 days prior to the due date to avoid any mail delays. The address follows as: Target Card Services, P.O. Box 660170, Dallas, TX 75266-0170.

- Double-Check: Mailed payments won’t be visible early, so log into your account a few days later to confirm it posted.

This method’s a bit slower, so it’s best for planners. If you’re racing the due date, go online or in-store instead.

Pay via Phone

Are you short on time? Paying by phone is a lifesaver. Here’s how it works:

- Call Target Card Services: Call at 1-800-424-6888 for credit card payments or 1-800-394-1829 for debit or reloadable card queries.

- Get Verified: You’ll need your card number, bank account details, and maybe your SSN for verification.

- Follow the Prompts: The automated system will walk you through entering your payment amount and bank info.

- Confirm Payment: You’ll get a confirmation number for your records, so jot it down.

Phone payments are clutch for last-minute situations, but there might be a small fee, so ask when you call. It’s like texting a buddy for a quick favor—fast but maybe not free.

Why You Should Pay on Time?

We don’t like late fees, right?. Also, skipping payments is not good for your credit score.

For the credit card, missing a payment could mean a late fee (up to $41!) and a hit to your credit score.

The debit card pulls money straight from your bank, so you just need to make sure there’s enough cash there.

The reloadable card needs manual top-ups, so you’ve got to stay on top of that balance.

Think of it like keeping your gas tank full—you don’t want to stall out at the checkout.

Things To Remember

- Set Reminders: Set up a due date alert in your phone or use the Target app to notify you a few days early.

- Monitor Your Balance: Keep tabs on your account balance every week to stay updated. The app makes this a breeze.

- Avoid Minimum Payments: For credit card users, covering just the minimum can pile on interest. Try to clear the full balance when you can.

- Watch for Fees: Late payments or bounced checks can lead to fees. Keep your bank account loaded to avoid trouble.

- Reach Out if Stuck: Run into an issue? Call Target Card Services or swing by Guest Services. They’re there to help.

What If You Miss a Payment?

Nobody’s perfect, and missing a payment happens. For the credit card, you might get slapped with a late fee (up to $41) and a negative mark on your credit score.

Debit card users could face bank overdraft fees if funds are low. Reloadable card holders won’t owe fees, but you can’t shop if your balance is zero.

If you miss a payment, pay it ASAP and reach out to Target. They might cut you some slack if it’s a one-off.

Target Circle Card Perks

Besides making payments a breeze, the Target Circle Card is a total win. That 5% discount stacks up quick, especially if Target’s your go-to.

Free shipping on online orders and an extra 30 days for returns? Plus, the reloadable card’s great for keeping spending in check. Just stay on top of payments to keep the good times rolling.

Wrapping It Up

Paying off your Target Circle Card bill is no no-brainer once you know your options.

Online and app are super convenient for on-the-go payments, paying in-store is great for hands-on folks, and phone payments work great when you don’t have internet or when you need them.

You can go for any mode of payment that fits your needs, set up reminders, and much more.

With this guide, you’ll be a payment pro, ready to keep those Target savings coming.